what is suta tax texas

These taxes are put into the state unemployment fund and used by employees that lose their. SUTA State Unemployment Tax Act is a payroll tax paid by all employers at the state level.

Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by.

. SUTA is short for State Unemployment Tax Act. It is unlawful for employers to avoid a higher unemployment tax rate by altering their experience rating through transferring business operations to a successor. Once paid these taxes are placed into.

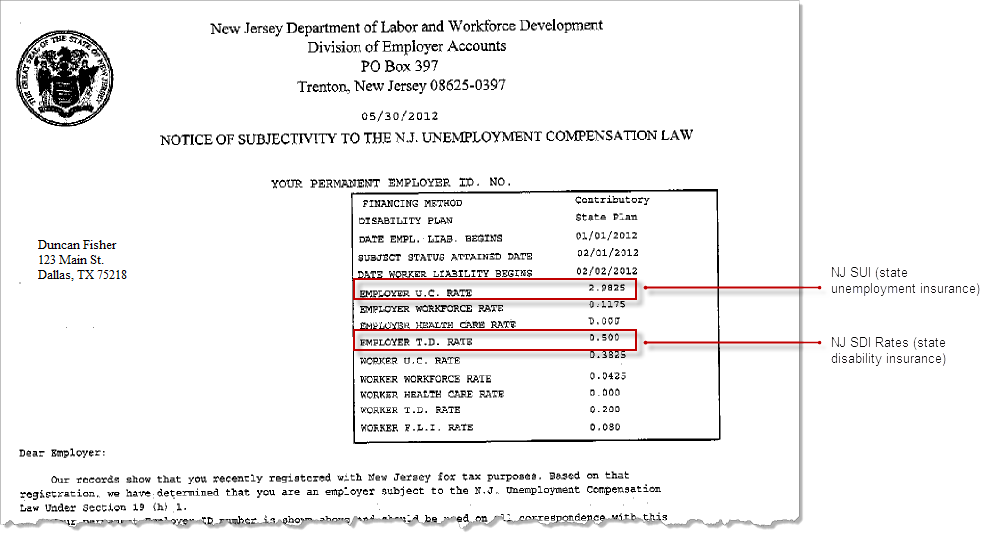

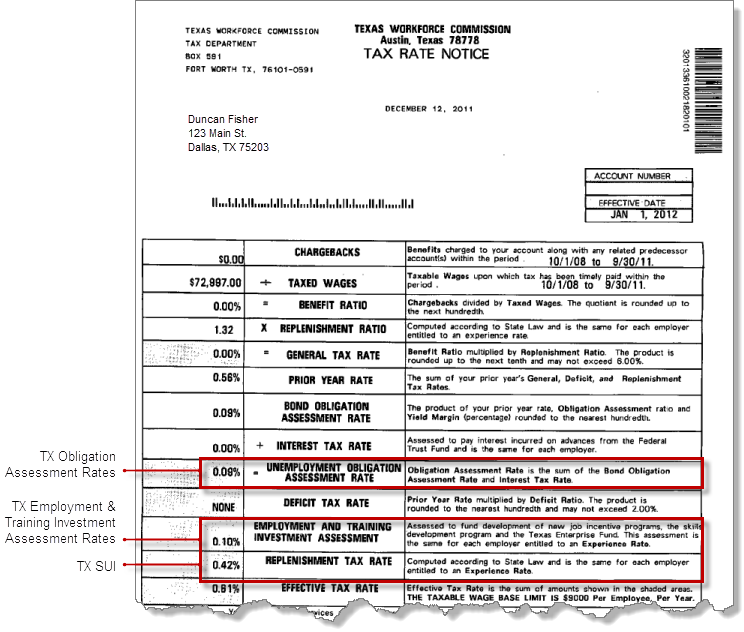

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. Generally states have a range of unemployment tax rates for established employers. An employers SUI rate is the sum of five components.

SUTA is a tax paid by employers at the state level to fund their states unemployment insurance. Once paid these taxes are placed into. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

What is SUTA. The Texas Workforce Commission TWC set the 2021 employers unemployment insurance UI tax rate in mid-June after a four-month delay as the state waited to see how the. Employers are required to pay these taxes which provide.

52 rows Most states send employers a new SUTA tax rate each year. Besides the FICA tax there are different types of related taxes called FUTA and SUTA which are simply unemployment taxes. The states SUTA wage base is 7000 per.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. These benefits are provided to qualifying employees by the. SUTA stands for State Unemployment Tax Act.

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. This tax is a payroll tax that businesses must pay to fund unemployment benefits. Newly liable employers begin with a predetermined tax rate set by the Texas UI law.

FUTA or Federal Unemployment Tax is a similar tax thats also paid.

How To Calculate Unemployment Tax Futa Dummies

Payroll Software Solution For Texas Small Business

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Suta Tax Your Questions Answered Bench Accounting

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

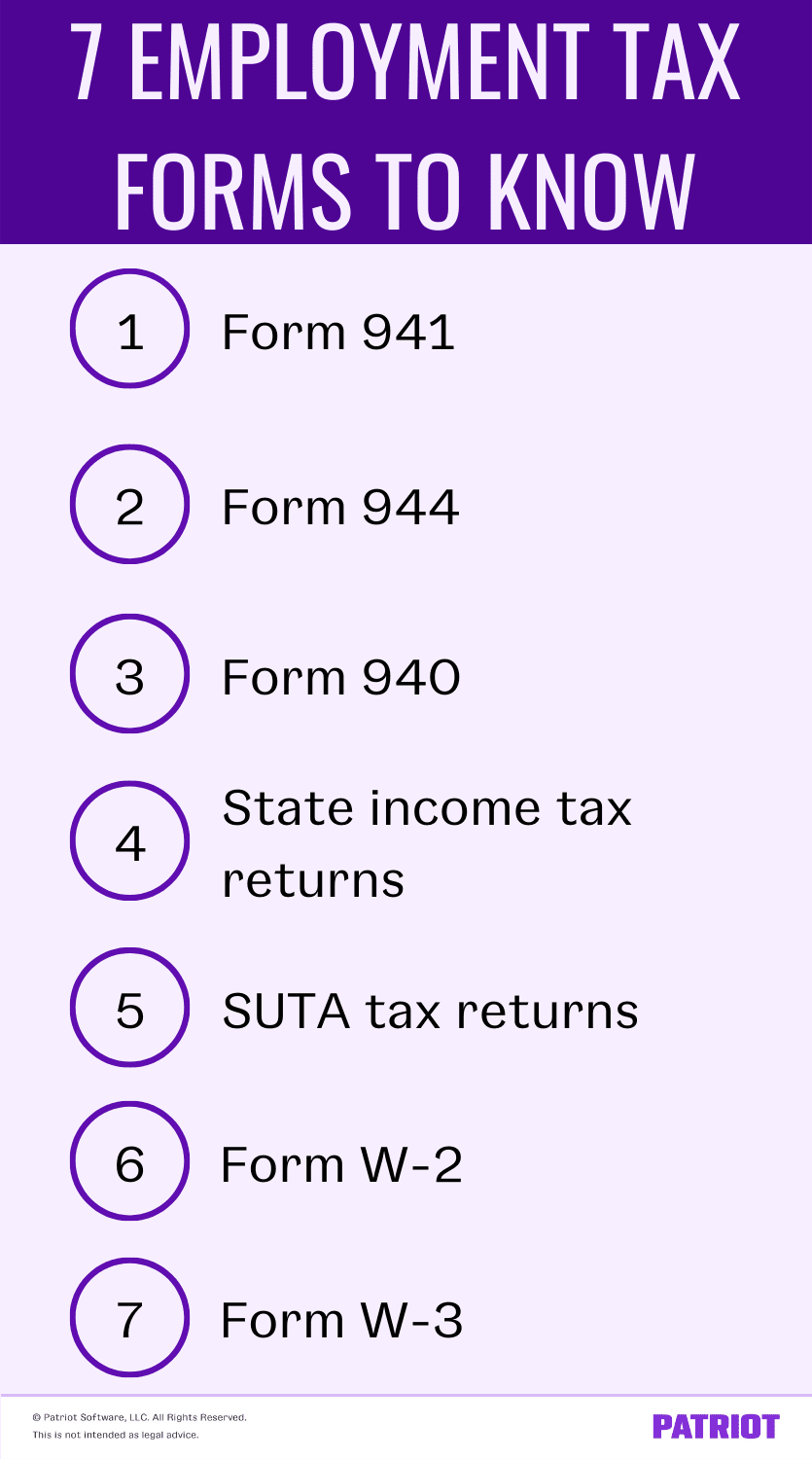

Employment Tax Returns Forms Due Dates More

Payroll Services In Texas Payroll Taxes Gov Links Payroll Taxes Payroll Payroll Software

What Are Employer Taxes And Employee Taxes Gusto

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

Our Company Is Agricultural And Not Required To Pay Futa Or Suta How Can I Reflect This In Quickbooks So It Stops Calculating Those Taxes

Chat With Twc Navigating Texas Unemployment Insurance Chargebacks Youtube

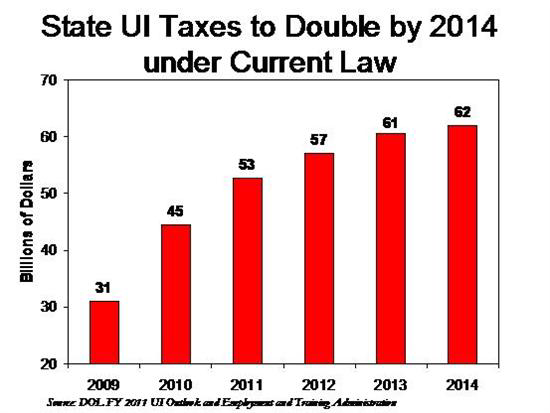

How To Reduce Your Clients Suta Tax Rate In 2014

Payroll Services In Texas Payroll Taxes Gov Links Payroll Taxes Payroll Payroll Software

The True Cost To Hire An Employee In Texas Infographic